[ad_1]

Marriott has lastly stepped into Indian Credit score Card area via HDFC Financial institution on Diners Membership community and launched HDFC Financial institution Marriott Bonvoy Credit score Card, a semi-premium co-brand journey bank card.

As you may need seen the highlights of the cardboard beneath the launch article, right here’s the detailed overview of the Marriott Bonvoy Credit score Card,

Overview

| Sort | Co-brand Journey Credit score Card |

| Reward Fee | ~2% |

| Becoming a member of Price | 3,000+GST |

| Finest for | Becoming a member of/Renewal advantages |

| USP | Free Night time Awards |

As most Marriott accommodations settle for Diners Playing cards it’s logical for the Marriott Bonvoy Credit score Card to be launched on Diners Membership platform however it could have acceptance points in any other case relying on the place you plan to make use of the cardboard.

Charges & Advantages

| Becoming a member of Price | 3,000 INR+GST |

| Welcome Profit | 1 Free Night time Award (valued upto 15,000 Factors) |

| Renewal Price | 3,000 INR+GST |

| Renewal Profit | 1 Free Night time Award (valued upto 15,000 Factors) |

| Renewal Price waiver | Nil |

The welcome/renewal profit is well valued at 7500 INR or extra and so undoubtedly profitable for anybody to get the cardboard with out pondering a bit.

Design

You’re seeing one of many first few Marriott Bonvoy Playing cards printed within the nation.

Appears lovely isn’t it?

The design appears neat, elegant and easy and provides vibes of a brilliant premium / invite solely bank card due to it’s black color and golden prints on it, considerably much like the SBI Aurum Credit score Card.

I want it’s bit vibrant although and reasonably save this design for later, for a “hopefully” subsequent tremendous premium variant.

Rewards

| SPEND TYPE | Marriott Bonvoy Factors (PER 150 INR) |

Reward Fee % (assuming 1 Level = 50Ps) |

|---|---|---|

| Common Spends (Home & Intl) |

2 | 0.66% |

| Journey, Eating, Leisure | 4 | 1.33% |

| Marriott Lodges | 8 | 2.66% |

- Reward Fee is calculated assuming 1 MB level = 50ps however it will probably go as excessive as 1 INR (or) even past based mostly on varied components. But, with most accommodations in metro cities & vacation areas, its often valued at solely 50Ps.

- Excluded spends for Rewards: Gas, pockets load, Gov spends, EMI & Lease.

- It takes 12 weeks following the Credit score Card billing cycle for Factors to be added to the Marriott Bonvoy Member Account.

The reward price on the on-going spends is poor even for the spends at Marriott Lodges, which I ponder why!

Ideally one can simply go together with 5x/10x rewards on HDFC Tremendous Premium Playing cards and luxuriate in way more financial savings.

Nevertheless, if you want the nights to build up on Marriott and get nearer to Gold/Platinum/Titanium, then reserving direct and paying at resort is the one possibility.

That apart, asking 12 weeks for factors switch in 2023 is unacceptable.

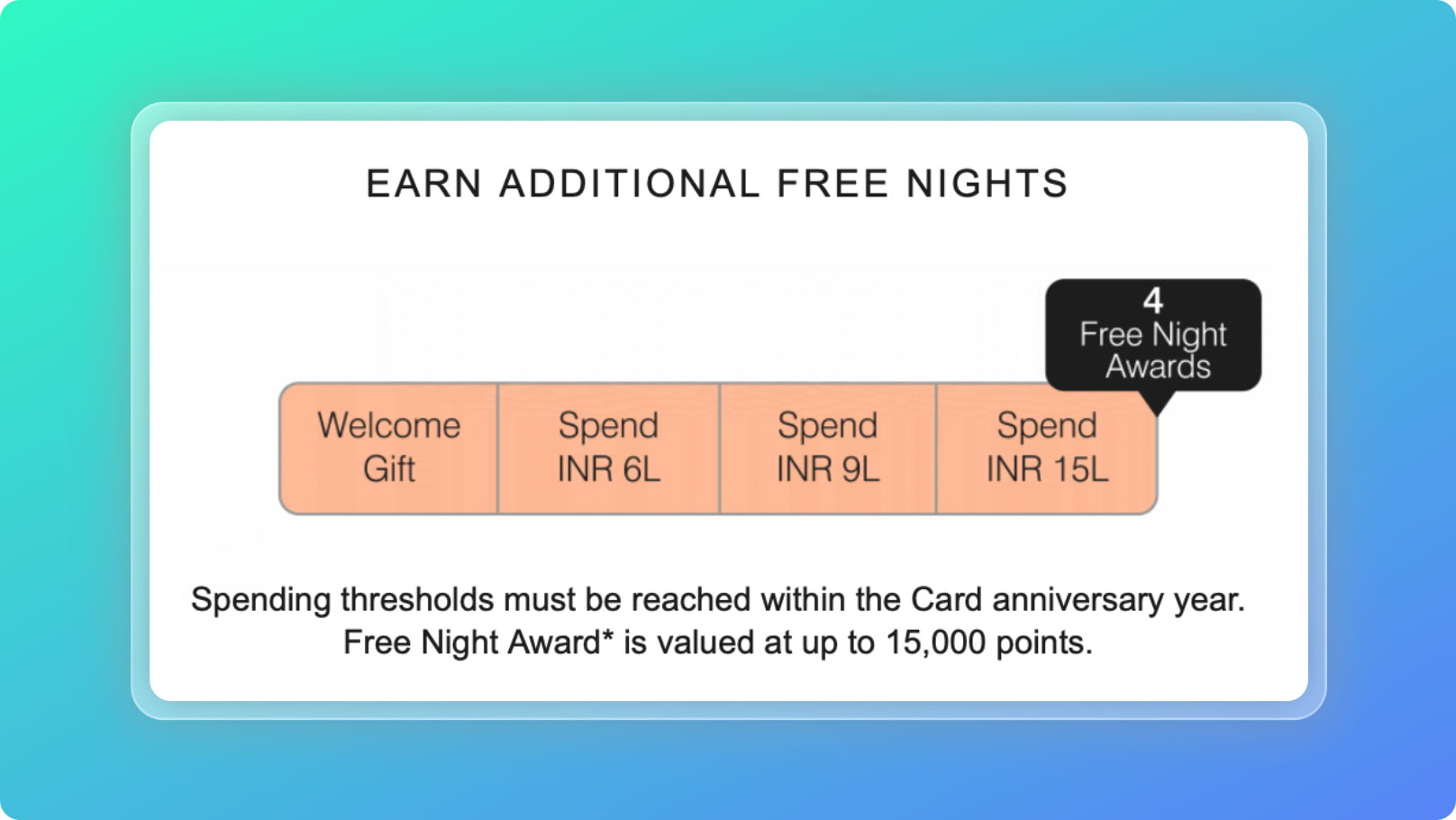

Milestone Profit

| SPEND REQUIREMENT | MILESTONE BENEFIT (Cumulative) |

Reward Fee (Cumulative) |

|---|---|---|

| 6 Lakhs | 1 Free Night time (1 Night time) |

1.2% (1.2%) |

| 9 Lakhs | 1 Free Night time (2 Nights) |

2.5% (1.7%) |

| 15 Lakhs | 1 Free Night time (3 Nights) |

1.2% (1.5%) |

- Free Night time Award (FNA) reserving capped at 15,000 Factors

Above calculation is completed by contemplating the entire 15K factors at 50ps. Ideally some would redeem at even 10K factors, wherein case the reward price would drop even additional.

So even when one combines each milestone & common rewards, the utmost reward price is hardly ~2% and that’s too low within the trade that simply provides over 4% on journey playing cards like Axis Magnus (for burgundy), Axis Atlas, Amex MRCC & Amex Platinum Journey.

Free Night time Award

- Worth: Upto 15,000 Factors

- Validity: 1 12 months

- Fulfilment: 12 weeks, upon cost of charge or assembly spend thresholds.

Whereas Free Night time Award’s (FNA) can be utilized to redeem for accommodations that requires 15K or decrease, you might also redeem them at accommodations requiring past 15,000 Factors by clubbing the factors (upto 15K extra factors) obtainable in your Marriott Bonvoy Account.

Let’s say a resort requires 20,000 Factors for redemption, you might use 1 FNA + 5,000 factors out of your Marriott Bonvoy Account. This manner one can make the most of the entire 15,000 factors of the Free Night time Award.

Nevertheless, be aware that how above truly works will probably be identified solely after we expertise it in actuality. I’ll replace this part as soon as I get my FNA.

Elite Night time Credit

- 10 Elite Night time Credit

- Fulfilment: inside 60 days of the becoming a member of/renewal charge cost

When you’re new to Elite Night time Credit, it’s principally a complimentary evening given to you by Marriott which is helpful to get nearer to the following tier beneath Marriott Bonvoy Loyalty program like Gold/Platinum/Titanium.

It’s pretty much as good as getting nights in your keep with out truly staying. It’s additionally eligible for lifetime standing of the Marriott Bonvoy Member.

Silver Elite Standing

- Precedence Late Checkout

- 10% extra on factors than common member

One must spend 10 nights at Marriott accommodations to ideally get to the Silver Elite Standing. Nevertheless, with this card it could be given as complimentary.

Truthfully, Silver Elite will not be a giant deal for accommodations and so there is no such thing as a main benefit to essentially get some worth out of it.

Airport Lounge Entry

- 12 Home complimentary lounge entry (per 12 months)

- 12 Worldwide complimentary lounge entry (per 12 months)

One of many main benefit of this card is it’s beneficiant annual lounge entry limits with none quarterly capping, which makes life lot simpler.

On high of it, because it’s issued on Diners Membership platform, cardmembers can entry the lounges immediately by swiping the cardboard on the lounges with out having to hold one other Precedence Go.

Golf Profit

- 2 Video games/Classes per Quarter

Whereas reserving Golf video games/classes on HDFC Financial institution Credit score Playing cards are little bit of a course of over electronic mail, 2 entry per quarter on a card at this value level is actually good to have.

The Issues

- Whereas the cardboard comes with a beautiful worth for it’s welcome/renewal profit & different life-style advantages like lounge/golf, it’s a poor card for ongoing spends. Therefore possibilities of folks getting the cardboard and never utilizing them can be excessive. Hope the banks runs some provides to maintain them energetic.

- The FNA on welcome profit is anticipated to be issued in 12 weeks submit clearance of the cost. That’s an excessive amount of time in 2023. I want they velocity up the system like in USA the place one will get the welcome profit activated in per week or so.

Do you have to get it?

There could possibly be varied causes one would get the HDFC Financial institution Marriott Bonvoy Credit score Card. Listed below are few causes as to why you would wish this card:

- Becoming a member of Profit can provide 2x, 3x or much more worth, so its no brainer to get one for it’s becoming a member of/renewal profit

- When you’re wanting few elite nights to hit Gold/Platinum/Titanium, the ten free Elite evening credit can get you there quicker.

- When you’re discovering increased worth for factors than 50ps/level, then even the milestone profit can be fairly rewarding.

You would wish to take a name based mostly on above components to see if it actually suites your profile.

Getting the Card

You may apply on:

and select Marriott Bonvoy Credit score Card among the many choices proven submit authentication of your particulars.

When you’re already holding HDFC Financial institution’s Credit score Card, then you might request your RM to get you another card as a floater card, the choice of which isn’t in RM’s arms. Imperia Banking with a very good standing relationship & present credit score restrict often helps.

It’s being setup as a floater card for present bank card clients similar to the Tata Neu Credit score Card as a result of I can see a 5000 INR Credit score restrict which is anticipated to replicate the precise credit score restrict in per week or so.

Bottomline

Total the HDFC Financial institution Marriott Bonvoy Credit score Card has excellent worth proposition for the charge it comes it.

Nevertheless, given that every one three manufacturers making the cardboard are into premium section, they might have simply gone for a 5K/10K charge variant.

That’s stated, one thing is best than nothing. But I might proceed to hope India quickly will get a Marriott Bonvoy Credit score Card with on the spot platinum profit!

Anyway, it’s a beautiful starting of in all probability a lifelong relationship with the Marriott Bonvoy Credit score Playing cards in India.

Have you ever utilized for the HDFC Financial institution’s Marriott Bonvoy Credit score Card? Be happy to share your experiences within the feedback under.

[ad_2]